Axo (Maladex) teases launch surprise on Cardano, on September 28th

Axo (Maladex) is a highly anticipated Cardano DEX protocol that will heavily limit impermanent loss through novel programmable swaps and algorithmic automated market makers (AAMM). The DEX also aims to increase capital efficiency, while at the same time making market-making and price discovery more efficient. Borrowing from QuantFi and TradFi, it aims to use realistic pricing and liquidity curve models.

Note: Maladex has rebrandex to Axo. For simplicity, the term Maladex in this article refer to Axo.

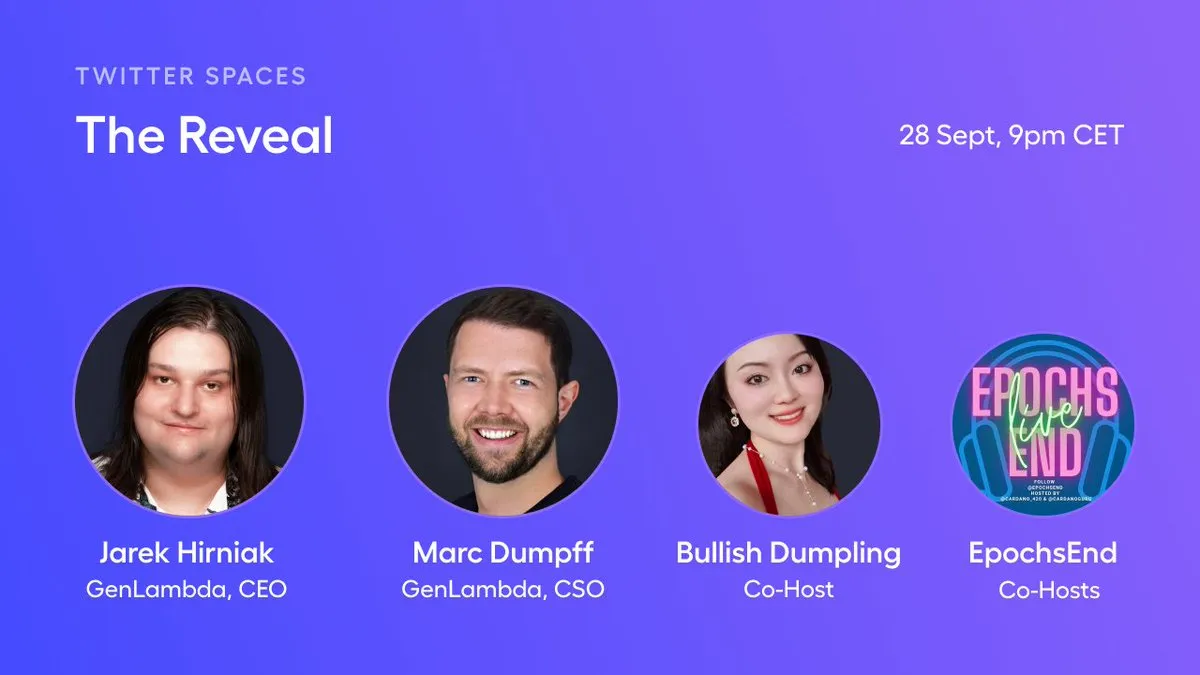

Since September 18th, Maladex has been on a 10-day countdown, that will result in them making an announcement on September 28th, at 9 PM CET. The community is invited to join in via twitter spaces.

This reveal has the Cardano community excited over what the DEX may announce. Will it be a testnet, a mainnet launch, or an NFT launch? If it's a mainnet launch that will be a pleasant surprise.

Here is a list of all clues that the maladex team has published via twitter:

Axo (Maladex) Development

The Axo (Maladex) protocol is developed by Generation Lambda, which is led by its founder Jarek Hirniak. The team members have mixed expertise in Haskell, software development, traditional finance, academia (professors) & research.

Axo has a team of about 2 dozen specialists. Here's an overview of some of the key team members' roles and experiences:

| Name | Role at Maladex | Experience |

|---|---|---|

| Jarek Hirniak | CEO | - 20+ years of software development experienc - former team leader, developer, quant for Citadel Securities and UBS - Authored Maladex whitepaper |

| Marc Dumpff | CSO | - 15+ year experience as finance professional, advisor, consultant, strategist, hedge fund & asset manager - helps with market research and institutional adoption at Axo (Maladex) |

| Alexander Granin | Haskell team lead | - software architect & developer published author on Haskell software design 14+ years developer experience |

| Jonathan Thaler | Haskell team co-lead | - PhD. computer science 20+ experience in software design, architecture, computer simulation & Haskell |

| Korneliusz Caputa | Front-end lead | 10+ experience in design, full-stack dev & functional programming |

| Milan Houter | UX/UI lead | - A Cardano native - Founder of Cardano Cube 10+ experience as UX/UI designer |

| Robin Boening | Special projects lead | - A Cardano native - Owner of LACE Stake pool - 20+ years experience in development & design |

| Tomasz Brengos | formal verification lead | - A Cardano native - A professor at Warsaw University - 20+ years experience as a category theory, functional programming & formal verification researcher |

Axo (Maladex) Tokenomics

Maladex protocol utility token is MAL. It will have a supply of 42 million tokens.

| Distribution | MAl tokens | % MAL |

|---|---|---|

| Platform rewards | 16,800,000 | 40% |

| Maladex treasury | 10,500,000 | 25% |

| Team | 8,400,000 | 20% |

| Private Sale | 2,100,000 | 5% |

| Airdrops | 2,100,000 | 5% |

| ISPO | 2,100,000 | 5% |

MAL's initial supply at launch will be around 10% (4.2 million MAL tokens). This initial allocation will come from private and public allocation and a potentially small amount (about 1%) of initial liquidity bonding.

The MAL tokens allocated to the team will vest linearly for a 5 years period. Each year, a fifth of the team's allocation i.e 4% will be released.

Axo initial distribution (ISPO) ended at the lapse of epoch 327. Participants who delegated to MAL, MAL2, XMAL, ANMAL & DRMAL were eligible for these MAL tokens. These pools are now retired.

Axo has published its airdrops allocation formula. This formula was carefully determined to achieve the following goals:

- To promote equitable distribution of MAL tokens by thwarting whale manipulation.

- Deliver incentives for early adopters so that they're adequately compensated.

- Promote a lottery (surprise) aspect that will encourage delegators to participate, since they too can be compensated randomly.

MAL token utility

According to Maladex v1 whitepaper, the MAL token will have the following utility.

- native settlement unit of account for hydra head (layer 2) execution and programmable swap resources;

- computational credits for back-testing and access to high volumes of historical data;

- consumption of on-chain oracles;

- one of the rewards to DeFi educational content creators;

- payment for access to a series of professional data;

Maladex treasury

The 10.5 million MAL tokens allocated to the protocol's treasury will help achieve the following:

- Fund development, protocol infrastructure, and DeFi research at Maladex

- Be distributed among Maladex users' as incentives. This distribution once the initial platform incentives allocation i.e (16.8 million MAL tokens) has vested.

- Reward educational content writers (influencers)

Community participation and funding

Maladex has been an active participant in the Cardano community. On Twitter, and via its medium page, the platform has been publishing education content i.e TradFi Tales. This is a series of stories that goes over the loopholes of traditional finance. How they have been exploited before and how DeFi can help build more transparent, trustless, and resilient financial systems.

The Maladex Team has submitted proposals to Project Catalyst and was even funded via fund 6.

The protocol will eventually open-source code to the wider Cardano community. Probably after its launch. Already its whitepaper has inspired other dApps e.g Genius Yields.

The team also developed a DeFi glossary that community users can use to familiarize themselves with crypto lingo

First published on Sep 25, 2022

Cardano